Through the evolution of health care, providers have determined their own prices. The result is a broad range of price variances from one provider to another! The price of a procedure (big or small) will vary simply depending on where the procedure is taking place and who is performing it.

It’s no secret the high cost of health care has many employers feeling limited in their options and ability to provide quality benefits at an affordable cost. Several options exist beyond simply shifting costs to employees. One such option is reference-based pricing (RBP). RBP helps address the cost of care while also addressing employer concerns regarding the affordability of health care benefits.

What is reference-based pricing?

Reference-based pricing is a health plan strategy where the employer sets a ceiling on the amount it will cover for a procedure rather than having the provider determine the cost. Providers are then asked to accept the RBP payment, or provide justification as to why their fees exceed reasonable and customary charges.

To achieve optimal results for both the employer and member, integrating RBP in health coverage requires specialized administrative capabilities best served by third party administrator (TPA) organizations.

Health plan coverage rarely covers the full amount of any procedure. Cost is typically covered by a combination of funding such as co-pays, deductibles, plan coverage, Medicare or Medicaid.

Here’s how reference-based pricing works

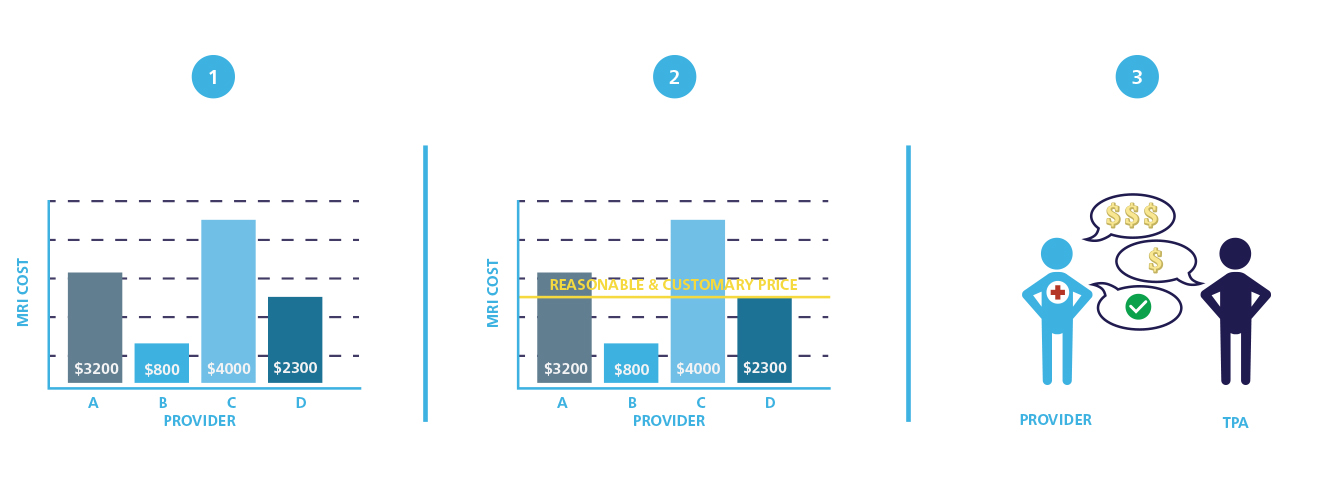

- Health care providers charge drastically different prices for the same procedure.

- Each geographic market has an established “reasonable and customary” price for that procedure.

- TPAs use reasonable and customary (ie. reference-based) pricing to negotiate with providers to ensure that their employer and member clients are not over-charged.

Example of cost variance: MRI

For example, the cost variance of an MRI might range between $800 and $4,000 or more. However, the quality of the procedure and care provided is basically the same. RBP eliminates the variance with a set amount and ensures a win/win/win scenario:

For example, the cost variance of an MRI might range between $800 and $4,000 or more. However, the quality of the procedure and care provided is basically the same. RBP eliminates the variance with a set amount and ensures a win/win/win scenario:

- The patient receives quality care at a more affordable cost.

- The provider receives fair payment for their services.

- The premiums begin to stabilize for the employer and employees.

Why is reference-based pricing beneficial?

The objective is simple – address healthcare costs for individual employees and employers. The benefits of RBP however have a far reaching, ripple effect throughout the healthcare community. The intent is to provide an effective tool to help stabilize the cost of healthcare.

![]()

Employees

RBP takes guesswork and worry from employees regarding price – specifically, out of pocket costs. It also encourages members to engage proactively in managing their healthcare costs.

![]()

Employers

Managing cost is a primary motivator of employers choosing self-funded health plans. RBP leverages every opportunity to proactively achieve optimal cost management while still providing quality health care to members.

![]()

Healthcare Community

Setting fair value pricing through RBP helps create a competitive market focused on improved results through quality performance at an affordable cost.

Frequently Asked Questions

Q: How will reference-based pricing affect my employees?

A: Plan members must be informed and engaged throughout their healthcare experience to ensure the right coverage outcome. Asking questions about the cost of a procedure is encouraged. Staying informed about providers who are RBP compliant is recommended. Patients still have a choice in using non-compliant providers but in doing so assume responsibility for the balance beyond the cost ceiling set by RBP.

Q: What happens if employees face emergency situations?

A: Reference-based pricing is one tactic within an employer’s health plan provisions. Emergency situations are covered per the provisions of an employer’s full plan benefits – so members should always follow the established protocol for an emergency or life-threatening situation. In many cases, reference-based pricing can still have a positive impact in managing costs associated with emergency care as third party administrators provide patient advocacy assistance in these situations.

Want to Learn More?

Additional SmartSheet topics are available on the Educational Resources page.